Do condos need homeowners insurance?

What you own when you buy a condo is very different to when you buy a house and the insurance you need also differs. Readers often ask me- Do condos need homeowners insurance? And the short answer is yes and no!

Do Condos Need Homeowners Insurance? : Condos do need insurance, but the type of insurance is slightly different from the traditional homeowner’s insurance you purchase when you buy a different kind of home. When you own a condo, the homeowners or condo association will have a master insurance policy. Individual unit owners must have an additional policy to cover their home.

Do Condos Need Homeowner Insurance?

As long as you have a mortgage on your condo, your lender will require you to have insurance. If something were to happen to your condo, there would be enough money from the policy to return your unit to its previous state and value. If this were not possible, the insurance policy would pay out the value of the property, and your lender would receive the balance of the mortgage owing.

Therefore, if you have a mortgage, you will have to have a condo insurance policy. However, it is also advisable to have this insurance even if you own your condo outright.

However.

A condo insurance policy is not the same as a general homeowners insurance policy.

How Is Condo Insurance Different To Homeowners Insurance?

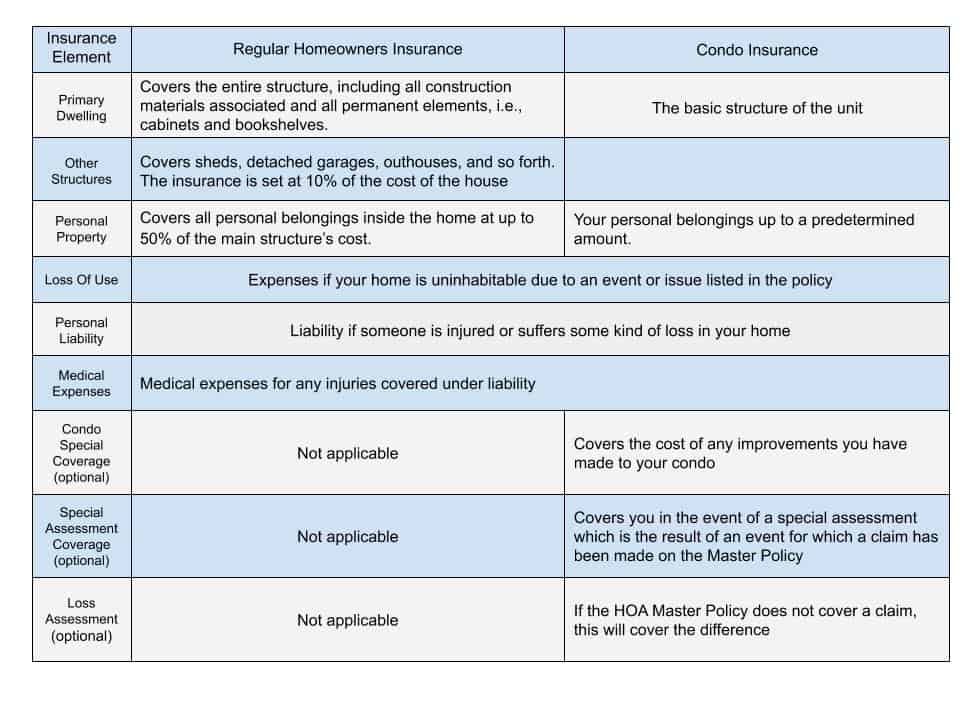

Regular homeowners insurance is made up of six elements:

- Primary dwelling

- Other structures

- Personal property

- Loss of use

- Personal liability

- Medical expenses

Meanwhile, condo insurance is made up of:

- Primary dwelling

- Personal property

- Loss of use

- Personal liability

- Medical expenses

- Condo special coverage (optional)

- Condo special assessment coverage (optional)

- Loss assessment (optional)

While both types of policy have private dwelling and personal property, there are differences in the details of what these cover. Basically, with condo insurance, you insure the unit from the drywall inward and your possessions.

Your HOA’s Master Policy

Condominium complexes are governed by a condo or homeowners association. The name may vary from complex to complex, but their function is the same. For the rest of the article, I’ll refer to HOA’s to cover all condo governing bodies.

A condos HOA will have what is called a Masters Policy. This policy covers the common areas of the condominium and is paid for by your monthly HOA fees.

The Master Policy will cover:

- Liability: If someone is injured, or suffers a loss in one of the condo common areas, this will cover any medical and legal costs associated with a claim against the HOA.

- Property damage: If a peril named in the policy, for example, a flood or a fire, causes damage to a common area, this will cover the costs of repair or replacement.

The master policy does not cover:

- The personal belongings of residents inside their units or in storage units belonging to the condo owner and within the condo complex.

- Improvements you have made to your unit.

- Loss or personal injury which occurs inside your unit.

How To Choose Condo Insurance

Condo insurance policies vary from provider to provider. When you are shopping for insurance, don’t automatically buy the cheapest policy you find. Instead, begin by working out exactly what you do and do not need

Check Your HOA’s Master Policy

Begin by checking the details of your HOA’s master policy. They may hold a “bare-bones” type policy which, for example, doesn’t cover flood damage. This might be an issue if you are on the ground floor of the condo, and there is damage caused to your unit and the common areas by flooding.

The master policy may also inform what level of insurance you choose to buy and the deductible attached to your policy.

Cash Value, Or Replacement Costs?

When insuring your personal belongings, you will have the option of either cash value or replacement costs. Cash value gives you the money you paid for an item initially, and replacement value gives you enough to replace an item at today’s prices. As you might expect, the premiums for replacement cost insurance are higher.

Contents vs. Structure

It can be challenging to know for some items, whether they are covered as personal belongings or as part of the structure of your condo.

Contents are items such as:

- Furniture

- Jewelry

- Clothes

The structure includes things such as:

- Light fittings

- Counter-tops

- Flooring

Therefore, if you have made upgrades and improvements to your condo, it is essential to ensure your level of coverage reflects the new values.

How Much Coverage Do You Need?

For your contents and structure elements of your insurance, you should be able to choose different levels of coverage. To work out what level of coverage you need to begin by walking around your condo and listing everything in it.

Many people are surprised by just how much stuff they have.

Then, list the current value of each item if you are going for a cash value policy, or how much you would need to pay to buy a new replacement if you are going for a replacement value policy.

Also, you will want to check your potential policy for limits on certain items such as jewelry. Many policies will only pay out up to a certain amount for these items in the general policy and if you have something worth more than you might want to take out additional coverage.

How To Choose A Deductible

It may be tempting to choose the highest deductible possible in an attempt to save a little on your monthly premiums. Try to resist this temptation.

Instead, look at your budget and decide, honestly, how much could you afford to pay out-of-pocket tomorrow if something were to happen to your condo or it’s contents.

If you think you could find a quick $3,000 to go toward replacing your belongings, then you can be comfortable setting a deductible of $3K. On the other hand, if you would struggle to find any spare cash to go towards replacements or costs, choose as low a deductible as possible.

The higher premium may hurt a little each month, but not as much as not having enough money to replace your belongings will.

What Happens When I Need To File A Claim?

Some claims may be straightforward. For example, if you have insurance which covers damage to your electronics and your TV falls to the ground and breaks, you’ll file a claim with your own insurance company.

However.

Some claims may be more complicated.

So, for instance. If there is a fire in the condo, and it damages the main structure, common areas, elements of the structure of your unit and your personal belongings, things will be complicated.

Which insurance company pays for what will come down to questions of liability, where repairs begin and end etc.

Is Condominium Insurance Tax Deductible?

Generally speaking, condo insurance cannot be deducted from your taxes. However, there are one or two exceptions to this.

- If you rent out your condo to someone else, you may be able to deduct the condo insurance premium as a cost.

- When you run a business from your home, you may be able to deduct a proportion of the condo insurance as a business expense. You will also be able to deduct the price of any additional insurance that is required for specific items for your business, which you keep in your home.

Does Condo Insurance Cover Hurricane Damage?

If you have condo insurance, you will be covered for damage to your possessions and the interior of your condo from major storms such as hurricanes, tornadoes, and windstorms. Damages to fixtures, plumbing, or wiring may or may not be covered under the condo association’s master policy, as some condo policies cover fixtures while others only cover bare walls. If the master policy is a “bare walls” policy, then you may opt to get a condo policy that covers these items. It is always essential to understand the coverage your condo association carries so that you avoid coverage gaps.

Does Condo Insurance Cover Special Assessments?

Condo insurance policies do not typically cover special assessments. If this were the case, HOA’s could lower HOA fees, never put aside money for repairs and levy special assessments for regular maintenance tasks, knowing the resident’s condo insurance would cover them.

However.

Some policies will cover certain kinds of special assessments under the “named perils” section of the insurance. It works like this:

There is a flood in your building, and there is severe damage to the common areas. The HOA master policy may cover this, but there may be additional costs or costs beyond their level of coverage. In this case, the HOA may choose to levy a special assessment. A condo policy which has special assessment coverage for named perils may cover you for your portion of the assessment.

About The Author

Geoff Southworth is the creator of RealEstateInfoGuide.com, the site that helps new homeowners, investors, and homeowners-to-be successfully navigate the complex world of property ownership. Geoff is a real estate investor of 8 years has had experience as a manager of a debt-free, private real estate equity fund, as well as a Registered Nurse in Emergency Trauma and Cardiac Cath Lab Care. As a result, he has developed a unique “people first, business second” approach to real estate.

Geoff Southworth is the creator of RealEstateInfoGuide.com, the site that helps new homeowners, investors, and homeowners-to-be successfully navigate the complex world of property ownership. Geoff is a real estate investor of 8 years has had experience as a manager of a debt-free, private real estate equity fund, as well as a Registered Nurse in Emergency Trauma and Cardiac Cath Lab Care. As a result, he has developed a unique “people first, business second” approach to real estate.

Check out the Full Author Biography here.

This article has been reviewed by our editorial board and has been approved for publication in accordance with our editorial policy.